You think you can time this market? Good luck.

The math doesn’t lie. Timing the market can ruin your returns.

My buddy Matt Cerminaro, aka Chart Kid Matt, has this awesome chart that I’ve left below. Essentially, it highlights different annualized returns if you had missed a certain amount of ‘best days’ in the market.

There is a massive discrepancy between missing the best 25 days and just having stayed invested the whole time. It might not seem like that much off the bat. I mean, come on, it’s only 2.6%.

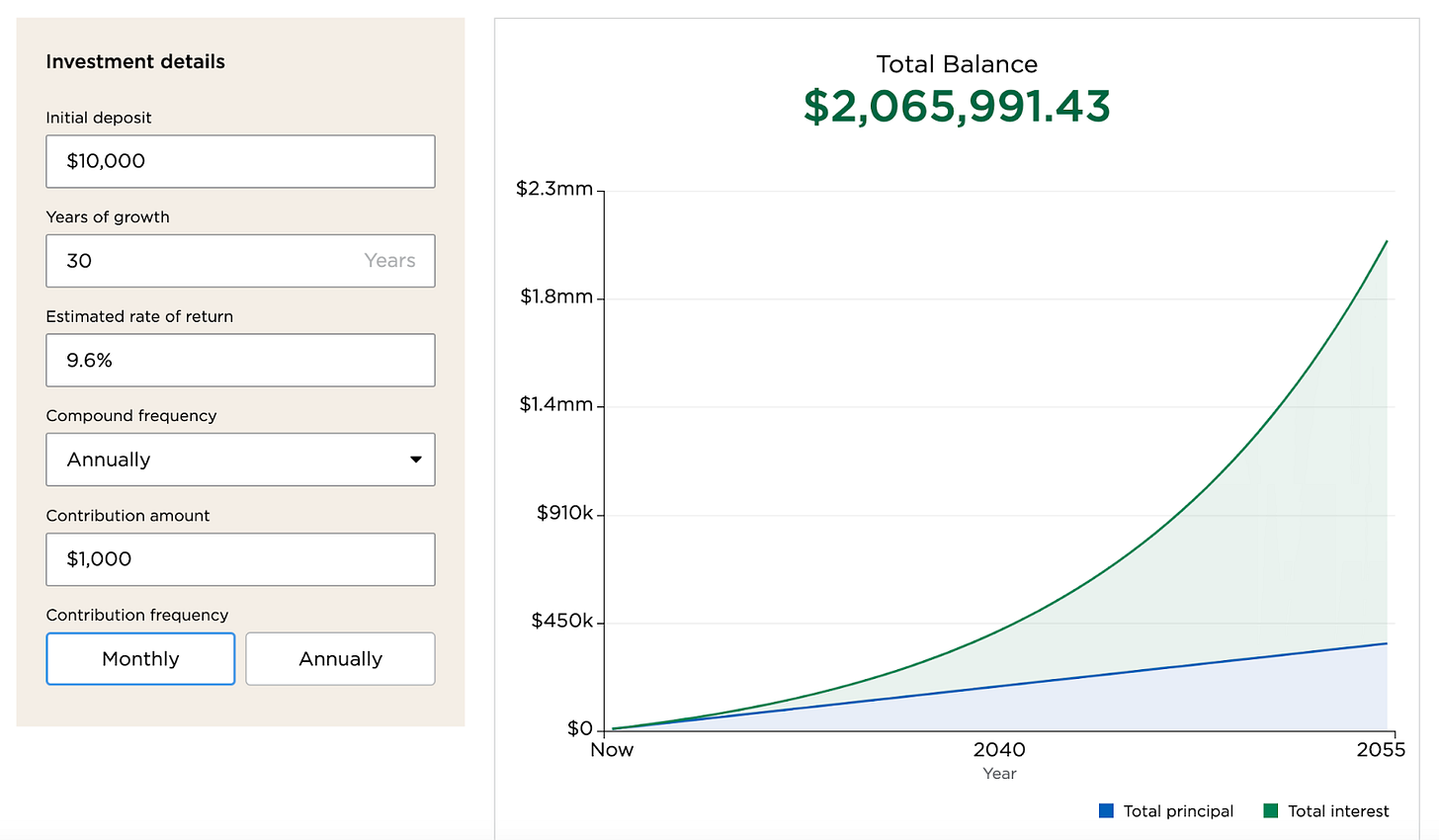

Here is what that 2.6% difference shakes out to over someone’s career. We’ll use a 30-year timeline and assume each investor invests $1,000 each month, starting with $10,000.

That ‘small difference’ of 2.6% annually becomes a difference of $820,416 over someone’s career. This is the risk of trying to time markets.

Below is a clip of some of the best days in the S&P 500’s history from a CNBC article.

Notice anything about those dates… 2008 and 2009… March 2020…

2008 and March 2020 were not amazing times for investors. But some of the best days in the market came during those times. And those days count towards the best days like Matt’s chart displays!

What I am getting at here is that for me personally, there is more risk in trying to time the market than there is potential to save myself from some of the inevitable downturns over the course of my investment journey. I am fully convinced that I cannot time this stuff.

Monday was a great example; stocks roared back on Monday. Everyone knows I am not a fan of timing the market, but now more than ever.

And for those who think they can time the market, good luck. You must get it right twice, which nearly no one can do. You have to exit and re-enter at the right time. If there is anything harder than getting out at the right time, it has to be finding the “right time” to get back in.

There will always be a million reasons not to invest. Don’t let today’s headlines stop you from building wealth over a lifetime.