Why the dollar losing value can be misleading.

Context is key.

So, lately I have been seeing a ton of “the dollar lost 10% of its value this year” type of posts online.

Great for engagement. This stirs the pot even more when we take into account the number of families that are really feeling inflation at the moment.

But there is a distinction that must be made. There are two primary ways in which the dollar loses value. Usually, when posting something like the screenshot above, no context is given. While it may be assumed that viewers understand the differences in how the dollar loses value, I’d prefer to add some context.

Essentially, the two primary ways the dollar “loses” value are as follows:

Inflation (this erodes purchasing power domestically)

Relative to other currencies ($1 may get you less of another currency)

Now, when the dollar erodes via inflation, it is something we feel in our everyday lives. Gas, groceries, and the essentials take more dollars to actually buy.

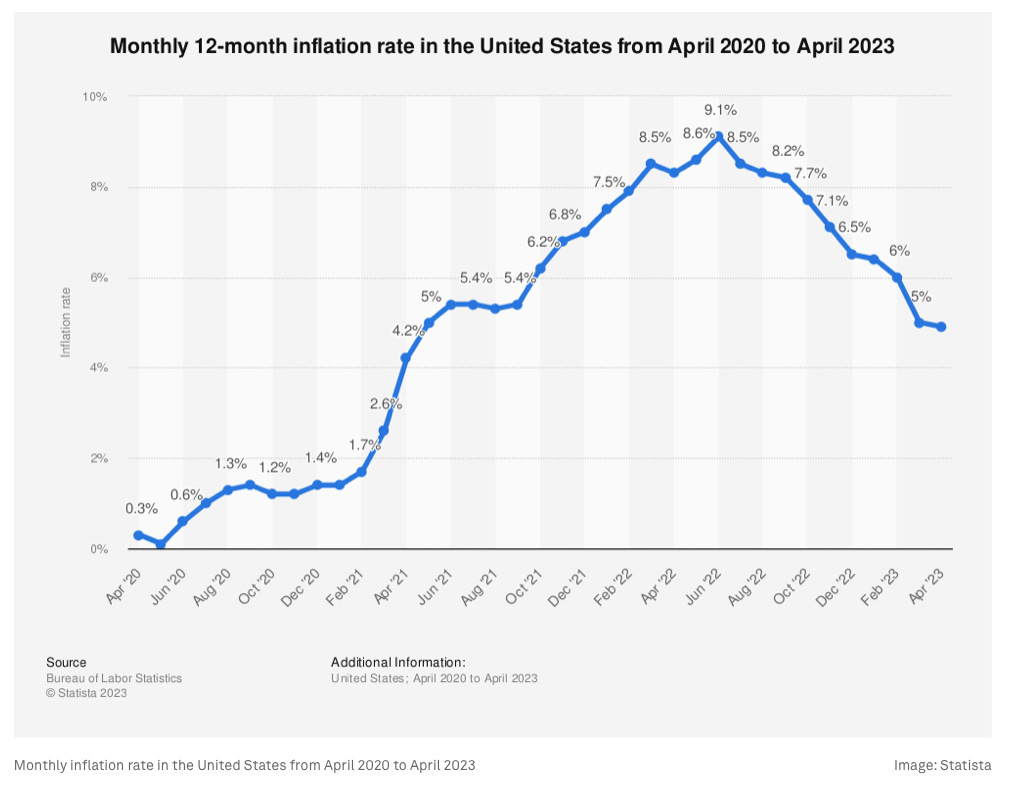

We are no strangers to this. 2022 was a tough year… The Fed targets a 2% inflation rate, so they say… Check out the chart below from the World Economic Forum.

The dollar losing value via inflation is something we may be more prone to actually feeling the impacts of. It hits our pockets, and consumers are usually very aware of these changes.

The second way the dollar “loses” value is slightly different. It is also likely what the initial screenshot was speaking to.

This is a loss of value relative to other currencies. Take a look at the US Dollar Index below from CNBC:

This is painting a different picture than just inflation. The US Dollar Index measures the value of the US Dollar relative to 6 other currencies. This includes the Japanese Yen, British Pound, Swiss Franc, Swedish Krona, Canadian Dollar, and the Euro.

So, it is showing something other than inflation or domestic purchasing power. Here is how I like to differentiate the two:

Inflation hurts our ability to buy things domestically.

Losing value relative to other currencies could make a vacation more expensive. If we went to exchange dollars, we’d get less of another currency.

DXY tracks more of an external value, while inflation tracks an internal erosion.

Interestingly enough, a weakening dollar is actually a decent tailwind for international stocks. We have seen that play out this year!

Nonetheless, it is important to have the facts to understand what someone is actually referring to when they bring up the dollar losing value. When nuanced topics are posted with little context, it can really stir the pot. The dollar “losing” value definitely falls into that category.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.