Where will the market go from here?

Don’t ask Wall Street…

One of my favorite things to do each year is to track Wall Street’s market predictions. Since I have been tracking it, they don’t really seem to know what will happen. Imagine that.

I covered this towards year end last year if you want some more commentary around Wall Street’s price targets, check it out here.

Generally speaking, these price targets are really more of a hobby of mine than anything I’d actually put weight in when it comes to allocating. It is incredibly hard to nail a 12-month price target, so hard that even when someone does, we have to ask ourselves to the extent luck played any part…

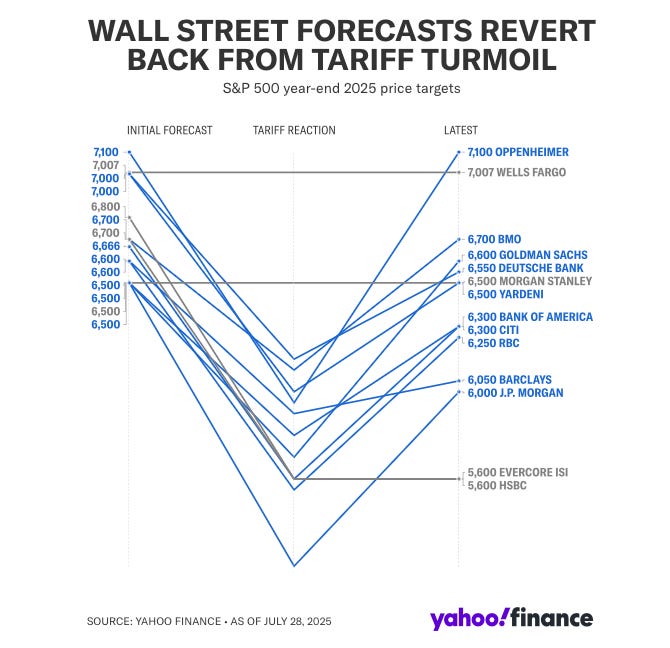

If you want a solid picture that points to the fact that it is reallllyy hard to make short-term predictions around the market, check out this awesome chart from Yahoo Finance.

Look at those initial targets. Then the tariff reactions. Then the latest mid-year revisions.

Do you know who these price targets help? Pretty much no one, at least in my opinion. Wall Street is notorious for making a prediction and then mid-year they get to change their decision depending on how the market actually moved.

For all of the volatility we felt earlier this year, the S&P 500 is up nearly 9% year-to-date. The NASDAQ is up nearly 10%.

I’m not saying don’t pay attention to the news… well, maybe a little bit… but Wall Street’s price targets are not something I would particularly let influence my long-term portfolio.

Risk tolerance, goals, and financial planning can all dictate how to allocate. This guessing game of how things will turn out, though? No, that’s not for me.

Over short periods of time, rash decisions within a portfolio can create tax-drag, make people susceptible to market timing, and interrupt compounding.

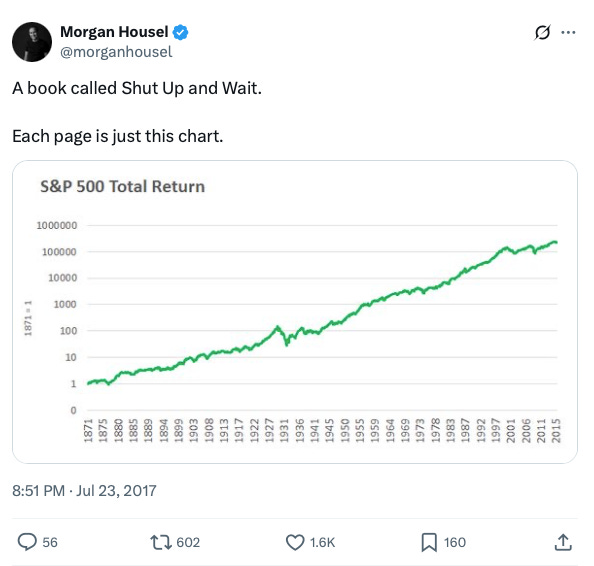

For me, I follow the Morgan Housel strategy as listed below:

When it comes to Wall Street’s price targets, JC Parets put it very simply on his recent episode on The Compound and Friends:

On the topic of price targets, he said: “I was sitting right here at this chair at the beginning of 2023, when every sell side analyst on Wall Street said the market was going down. It was Wall Street sell side consensus in ‘23, the stock market was going to fall. Not only did it not f***ing fall, the S&P 500 was up 20% two years in a row and the NASDAQ doubled.”

I listen to this podcast every single week. It is absolutely the best, and JC’s quote here might be my all-time favorite quote. He has a true passion for this type of stuff.

His quote is a great example of not allowing these price targets to influence a long-term portfolio. Take all of this financial media with a grain of salt.

Price targets have absolutely no idea what your time horizon is, what your goals are, or anything about your personal finances.

Generally, they should not have nearly the influence that some think they should.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.