Time: The Most Reliable Asset in Volatile Markets

Time can work wonders.

This weekend, I was scrolling X and I came across an awesome chart. I love different ways of posing time horizons and how helpful a long-term mindset can be.

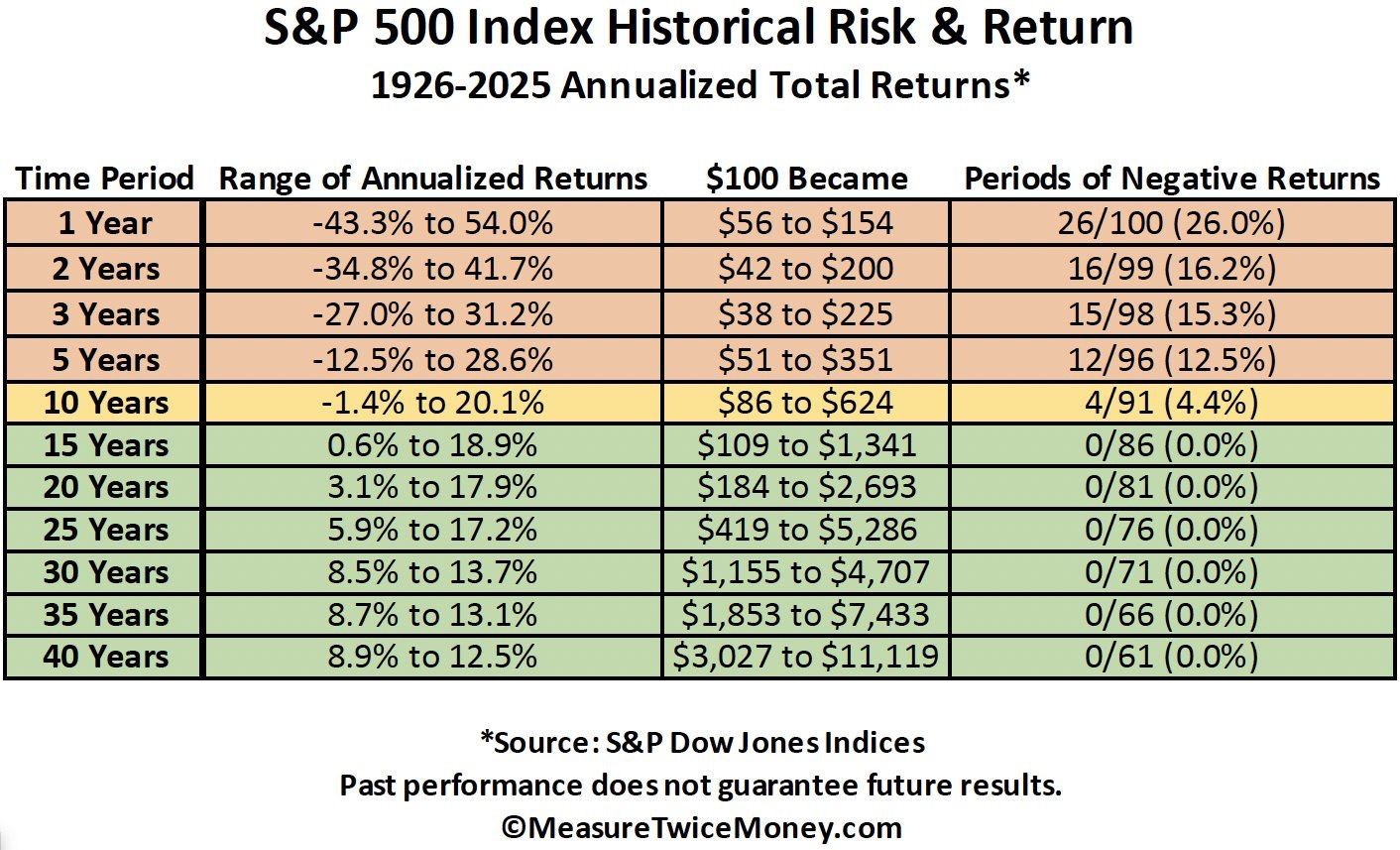

The chart I saw did just that. My friend, Cody Garrett, CFP®, has this amazing table showing a history of the S&P 500 index. Specifically, he highlights the annualized range of returns based on time horizon.

Side note: Cody just wrote a book. It is amazing and has been a great read. He cuts right through the nitty-gritty of taxes and outlines different tax planning strategies. If you’re interested, check it out here.

Here is the chart:

This is such an awesome visual. I love that we get a worst case and best case scenario for each time period.

First and foremost, let’s look at the 1, 2, 3, and 5-year time periods. Right off the bat, we can see that the range of performance is incredibly wide. For just a 1-year time frame, the return ranged from -43.3% to 54%!

I think this is important to note, especially for young professionals. That exact range is the reason most financial planners do not recommend investing funds that need to be used for an upcoming purchase.

Imagine having $100,000 saved for a down payment on a home and one year later that amount was $57,000?!

Now, the 2 and 3 year period can make that same case. While even the negative annualized return rises, this is annualized. Back to back years of poor performance can compound in reverse!

Note that the spread between the performance narrows as the time horizon extends. While we may feel volatility in markets over days, weeks, and months, the dispersion between returns over the long run fades.

My favorite piece of Cody’s work is year 15. On a rolling basis, there has never been a 15 year period of time in which the S&P 500 had a negative return. How nuts is that?!

Each time period thereafter only looks better. This is what I am talking about when I refer to having a long time horizon. Not only do young professionals have the ability to accumulate assets over a long time frame, but they can also take risks and actually participate in markets over a long period of time.

The market is always going to have periods of poor performance. For someone like me, I no longer even consider it a risk… I have cemented this as fact.

I know the market will pull back, correct and even crash. I don’t know when, I don’t know why, and I don’t know for how long.

I have found a lot of peace in not trying to time the next market cycle. I no longer worry about big drawdowns in the market because I have fully accepted that they will happen. It is no longer a question to me.

My time horizon is longer than the longest time period Cody left for us in the chart. I expect to be an investor for my entire life. Allowing the media, Wall Street, and some Twitter finance “gurus” to derail my plan is not in the cards.

If markets make you nervous, or if market volatility has you on edge, be sure to keep Cody’s work in your back pocket. It can offer a lot of peace of mind.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.