“This is just like the dot-com bubble”

Are you telling me Dow 200,000 by 2050?

There is a lot of buzz around this idea of a bubble. Let me be clear that I am not fully convinced that today’s market is in a bubble. Are there pockets of a bubble? Maybe… Is there some froth? Yes.

A ton of parallels have been drawn between Cisco in the ‘00s bubble and Nvidia. Cisco’s price-to-earnings ratio, a common ratio used in high-level valuation analysis, peaked at 200x. Nvidia currently stands somewhere in the mid-40s. Hot? Sure. Bubble territory? Not until earnings don’t follow the price, which has largely happened over the last 5 years.

These Mag 7 stocks and a few outside of AI companies are not necessarily the dot-com stocks. Their valuations, while arguably a bit high, are not absurdly overpriced… at least in my opinion.

Inflation is still kicking around, and we’re talking about some rate cuts in the new year with a potential change to the Fed Chairman.

*insert, “Get in loser, we’re gonna run it hot” meme*

Call me naive, but I don’t see a cataclysmic decline like the dot-com bubble on the horizon. (Come back to this and clown me if I’m wrong.)

Nonetheless, I keep seeing tons of takes about today’s market mirroring that of the dot-com bubble. For reference, the NASDAQ lost nearly 80% of its value. There is no way to skew that positively. An 80% drawdown is absolutely decimating.

The S&P performed slightly better, with only a ~50% loss. These are staggering losses, and I promise I am not trying to diminish how terribly these losses would feel.

The Dow Jones lost around 38% of its value. This is a more modest drawdown relative to its counterparts, the S&P 500 and NASDAQ.

Here is some bubble coverage for you! If you didn’t know of this, great. Most of it stands to spook you and get your gears turning. Making even the most rational investors second-guess themselves.

So, with all these people calling for a dot-com bubble repeat, I started thinking about how to phrase this back to them.

When someone says, “This is exactly like the dot-com bubble.”

I’m going to respond with: “Oh, really? So you’re calling for Dow 200,000 by 2050.”

The Dow is currently at ~48,500. That’d be a gain of over 300%.

Is that insane? Let’s find out. Below is each index and its value at the peak of the dot-com bubble:

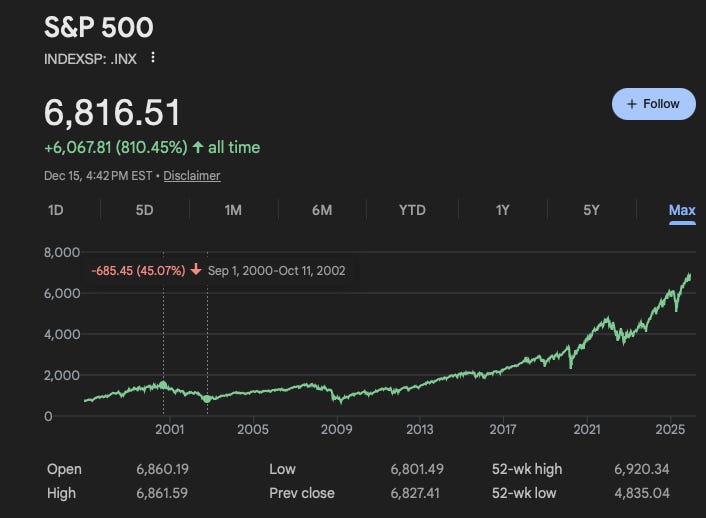

S&P 500: 1,552

DJIA: 11,750

NASDAQ: 5,048

Here are the current values:

S&P 500: 6,816

DJIA: 48,414

NASDAQ: 23,057

The percentage gain (excluding dividends reinvested) from the peak of the dot-com bubble to today:

S&P 500: 339%

DJIA: 312%

NASDAQ: 357%

Over 25 years, each index is up over 300%. So, if you want to tell me that today is a bubble that will play out exactly as the dot-com bubble did, are you telling me the Dow will be at 200,000 by the time I am 50?

Are you saying the S&P 500 will be at 27,272 and the NASDAQ at 100,000?!

Of course, we can’t know what will happen, and I highly doubt that this market will follow exactly in the same path as the dot-com bubble, but I think posing it this way can allow us to flip the switch and emphasize the importance of long-term time horizons.

Oh, you think the market is due for a crash in the next year? Awesome… where do you see it in 25-years, where do you see it in 30-years?

I’ll leave everyone with this:

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves”

- Peter Lynch

*Note: All charts used were from Google Finance.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.