The math isn’t mathing.

A quick review of what just happened.

Just for everyone’s sake, this piece will overview the past week. Take it with a grain of salt. I am trying to digest everything as well, but here’s what I have learned:

This past week was one of the most anticipated weeks in the market since the election. On April 2, we were set to get closure on the tariffs, who they’d be imposed on, and to what extent.

A lot of strategists were hoping for the best on April 2nd, initially painting the picture that when the market got clarity, there would be this resolution and that markets could finally price in the newly enacted tariffs.

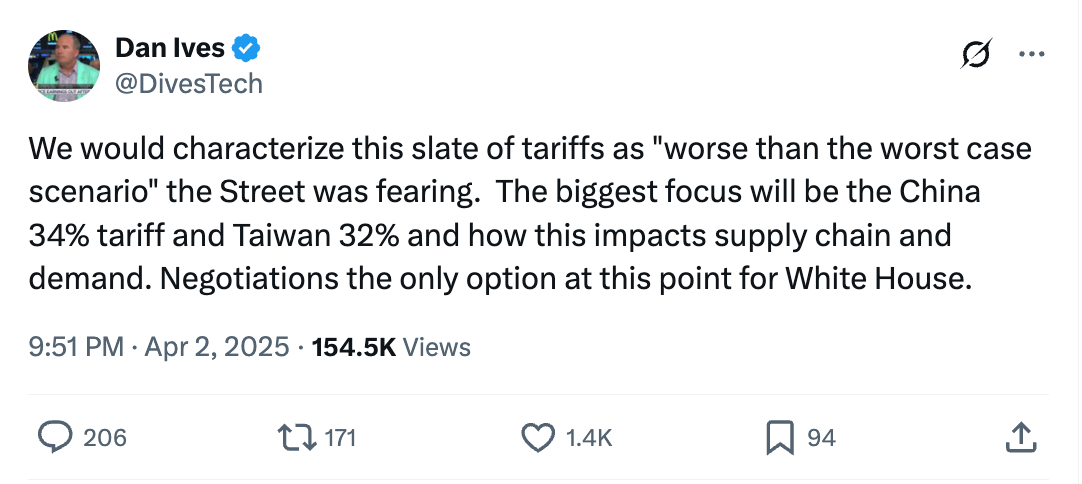

This was not the case. Upon the release of the tariffs, the market puked. We posted two historically dismal trading days. Everyone was upset. Wedbush MD, Daniel Ives said the tariffs are, “worse than the worst-case scenario.”

Now, what he means by worse than the worst-case scenario and what is likely driving such a steep sell-off is that the tariffs were worse than anyone was predicting. The market was working to price in these tariffs over the last few weeks. Wall Street analysts and strategists gave their best go at understanding the potential implications of the tariffs but the numbers on the chart were too far out of line with their expectations.

Although it might be a false equivalent, think of when people say, “XYZ company missed earnings!” No, they didn’t, Wall Street missed their forecast. In hindsight, it was apparent that no one was in the realm of what was introduced.

To add fuel to this fire, it appears there might be some confusion as to how we derived the tariffs themselves.

The internet is a wonderful place. Prior to the formula even being distributed, people on X were already cracking the code.

Someone found that the tariffs appear to be derived by taking the trade deficit with another country and dividing it by total US imports. See the post below for a simple explanation:

The market really seems to hate this. The tariffs appear to be more focused on closing a deficit than they are reciprocal tariffs. This leaves a lot of uncertainty for the opposing countries.

How do they negotiate? Do they help the US close its trade deficit with them or undo their own tariffs? In all honesty, I am not sure.

And that brings me to my main point. No one is sure. No one can really put their finger on what exactly is going on.

All I have gathered is that further clarity on how other countries can negotiate could be seen as a good thing for the markets. Some have even suggested legging into the tariffs, without such a forceful structure at the beginning and giving clear instructions on how this could be amended and resolved.

I’m not enjoying this. It is hard to watch this go down, but what can I do other than be positive?

I think back to COVID. That was one of the most uncertain times ever. We were not only uncertain of the job market, stock market, and international trade, but we were uncertain about the world population’s health. That was scary.

We made it through that. I think as the market learns more, we will see volatility dissipate to some extent. Again, I think, take that with a fat grain of salt, LOL.

The market has the funniest way of humbling anyone and everyone. Scroll X for a little bit to see some of the greatest minds in the market look foolish in hindsight. From billionaire hedge fund managers to economists to government officials and the average investor, the market does not discriminate when it comes to serving daily slices of humble pie.

Consensus was that this administration would be so pro-business that markets would boom. Consensus is now that tariffs are kryptonite for equity markets.

I don’t know what happens next, but I do know that markets persist. Stay the course. Find comfort in your time horizons and know that every wild thing the market has ever had thrown at it was inevitably followed by another all-time high.

I’ll leave everyone with this nice chart below from Hartford Funds. Notice anything? 8 out of 10 of the worst days in stock market history have resulted in double-digit annualized returns over a 5-year time frame.

I can’t know if that will happen again. But I wanted to end on a positive note.