Taking a look under the hood of the auto loan deduction.

How the car loan interest deduction really works.

Starting in 2025, car loan interest has become deductible to some extent. Many political figures have been touting this as a great thing.

Before we begin, let’s define a deduction. A deduction is something that lowers income subject to taxes.

For a quick, high-level example, if someone is in the 22% marginal bracket and they take a deduction of $1,000, they could expect tax savings of ~$220.

At face value, the auto loan interest deduction does seem great. This could potentially help more people afford their car payments, right?

Well… about that. Like I said, at face value, it seems a little better than it really is.

There are some stringent requirements to qualify for this loan and there are even income phaseouts to take into consideration.

This deduction can be up to $10,000 annually but here are the requirements:

The vehicle MUST be new

The vehicle MUST have been finally assembled in the United States

MAGI (modified adjusted gross income) must be below $100,000 for single filers to take the full deduction and below $200,000 for MFJ. The deduction is fully phased out when single filers breach MAGI of $150,000 and $250,000 for MFJ.

So, up to $10,000 as a deduction sounds solid. But… we can’t forget that we’d have to have paid a full $10,000 in interest alone to get this full deduction!

Without really taking a second look, which is what makes me very apprehensive about this deduction, it can be hard to fully grasp what would need to be borrowed to pay $10,000 in interest in the first year of a car loan’s life.

To emphasize the amount of the loan, let’s reverse engineer and solve for the present value of a loan that would result in $10,000 of interest being paid in the first year.

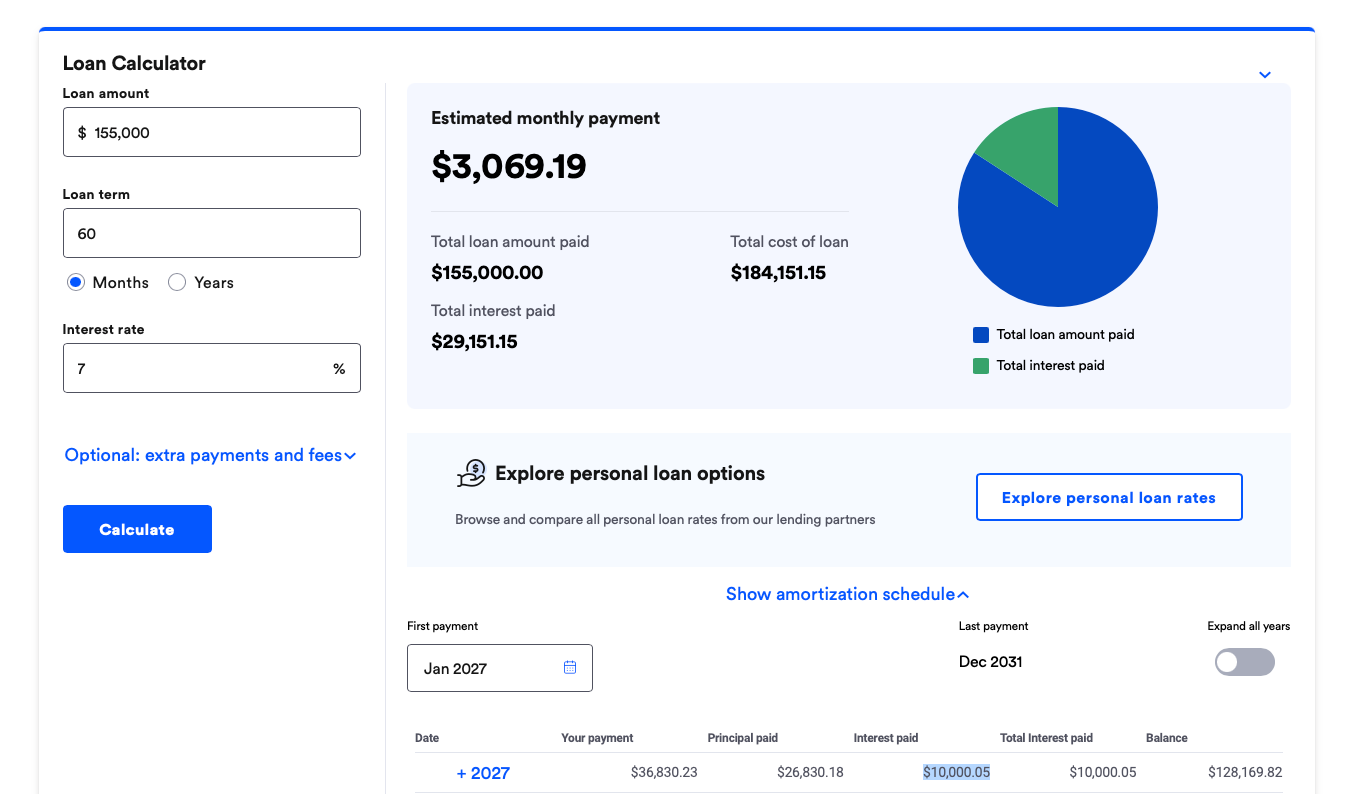

We will assume the term is 60-months with a rate of 7%.

~$155,000

Yes, one-hundred and fifty five thousand United States Dollars would need to be borrowed to deduct the maximum amount of interest in year one.

Check out the following from bankrate if you are skeptical.

So, while a deduction might be nice, now we can kind of see the extent to which someone who is earning ~$100,000 must borrow in order to take the full deduction in year one.

They’d need to borrow roughly 1.5x their annual income for an asset that depreciates the second it is driven off the lot.

Sorry, if I sound like a pessimist, but to me this is a wolf in sheep’s clothing. We know what predatory lending is, but has anyone coined predatory deductions yet?

To bring this back to earth, here’s a slightly more realistic example.

Let’s assume a new car costs $50,000. We’ll put down 20% and finance the remainder at 7% over 60-months.

This would result in ~$2,580 in total interest being paid over the course of year one. Remember, it is not the entire payment that is deductible, it is solely the interest paid.

We will also assume our borrower is in the 22% Federal tax bracket. This deduction results in tax savings of ~$567 in year one.

So, our borrower took on a $40,000 liability resulting in a monthly expense of ~$792 and they will save themselves about $567 in the first year.

Not horrible… IF they were in need of a brand new car and wanted to finance it. However, for someone who is earning less than $100,000, I am hard pressed to believe that financing a brand new vehicle is in their best interest.

Again, at face value, this deduction seems to be a great thing. However, without fully understanding the implications of taking on the debt and monthly payments, I’d venture to say that some will allow for this deduction to drive their decision in financing a brand new car.

Take a look under the hood of the deduction before allowing it to drive a decision… no pun intended.

While this deduction is set to help people, I am not fully convinced it will do more good than harm.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.