Setting the tone for 2025.

Some takes that have me thinking.

I have previously included Clifford Asness’ tweets in one of my old newsletters. Cliff is a hedge fund manager and the co-founder of AQR, which is a hedge fund that employs a quantitative trading approach.

Before we begin, to give Cliff some credit and to highlight his accolades as a true thought leader in the space and his accomplishments professionally:

He obtained his MBA and PhD in finance from The University of Chicago before he was 30. His firm currently has roughly $143,000,000,000 under management. That puts the firm in the top fifteen hedge funds by AUM in the world.

If you are interested in the history of quantitative finance, check out “The Quants: How a New Breed of Math Whizzes Conquered Wall Street and Nearly Destroyed It.”

It is an awesome book and Clifford is included throughout.

Anyway, Cliff recently posted some fresh Perspectives just as we began 2025. It is one of those pieces that really got the gears turning for me.

I encourage everyone to take a read of his piece which is linked here.

To recap what Cliff outlined throughout his fictitious and sarcastic look back on the market from 2025-2035 as he wrote from 2035, we see tons of investor psychology at work.

Now, I am not a proponent of trading. It is not something I can do successfully, nor is it where my time is best spent. I will leave that to the quants. But understanding what Cliff outlines can be very eye-opening for younger investors.

We have gotten pretty used to above-average, stellar, almost euphoric returns over the past 10 years. These returns are absolutely wild. Well into the double digits each year other than 2022 since 2019.

Here is a clip of the last 10 years for the S&P 500. This is not something anyone should get used to, although we welcome it with open arms any time this occurs.

Cliff gives a lot of insight into his thoughts on private markets and the way they fail to mark-to-market their investments. Essentially, mark-to-market is an arguably more accurate pricing metric for a private investment. Rather than what someone thinks something is worth, they would relay what the asset could actually be sold for at that point in time.

Public markets don’t work like that. If you tell me that you think Apple is worth $280, that is fine. But I can see it actively trading in the $240s.

I won’t speak too much more on the private side of things as I am not nearly as well versed as I should be in order to give opinions or overviews of that industry.

Here is what interested me the most from this fictitious look-back:

Cliff’s idea that US equities barely outperform holding cash over a decade. Now, I am not saying that this is what will happen but what if it did?

Is your portfolio really diversified enough to mitigate a decade’s long mediocre performance in US equities? Does your portfolio have exposure to markets that pose counter-cyclicality to US markets?

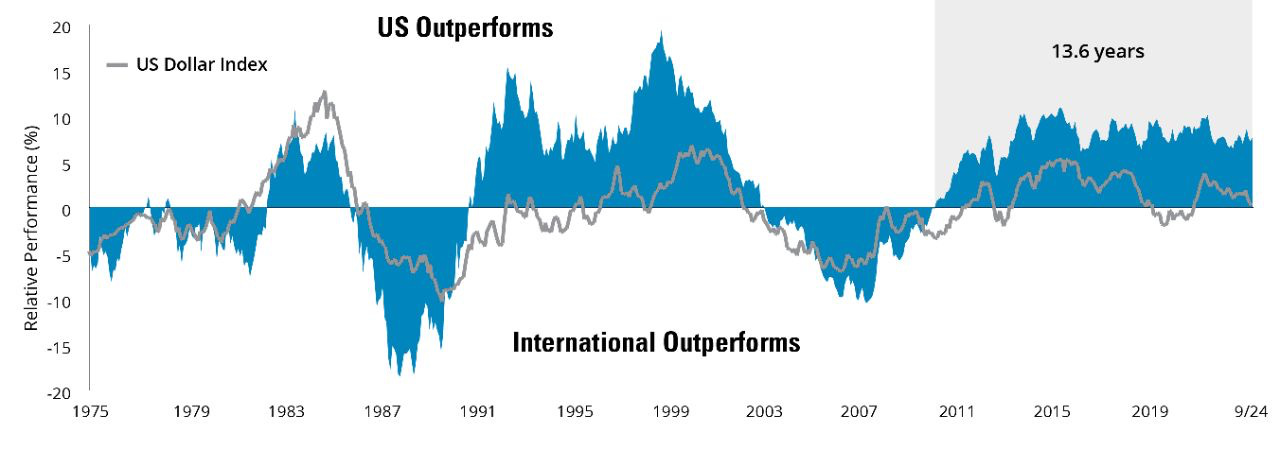

The idea that international equities were left for dead for the past 10 years and the idea that they began to perform well in excess of the risk-free rate and US equities.

This is huge. I was literally just invited to a small gathering with a strategist from a bulge bracket bank back in November. To sum up one of his quotes as he pitched synthetic income ETFs, “I mean, no client will ever be mad that you were underexposed to international markets.”

Right away, this is usually a tell-tale sign that too many people might be sleeping on the idea that international markets could very well outperform US equities over the next decade.

I don’t know what will happen. If I did, I probably wouldn’t have to work. But what we can do is position ourselves in a diversified manner.

Diversification is not just choosing an S&P 500 index ETF and putting money in.

I think I’ve sent this chart out before from Hartford Funds. Take a look at when international equities outperformed the US… Kind of like when everyone needed it most, huh? I think something happened around 2008.

To sum it all up, I want people to be aware of what actual diversification looks like. Even if you don’t want to diversify, you need to understand the risk you are putting on your money.