Secular Bear Market Remedies

Dollar-cost averaging

Prior to beginning this piece, I’d like to make it clear that this is not investment advice. This is for informational purposes only.

There is going to be a secular bear market in our lifetimes. It is inevitable. Since 1937, we have seen 3 of them. Recently, I was reading Barry Ritholtz’s new book, “How Not to Invest,” which had this awesome chart below:

This chart highlights secular bear markets and secular bull markets. To simplify the way Barry describes them, secular bear and bull markets are prolonged periods of either very low growth and little innovation or fast paced growth along with some type of catalyst (internet, AI, etc.)

Within a secular bear and bull market, you can have cyclical bear and bull markets. These are much shorter-term movements that don’t necessarily define an era, as a secular movement would.

Since 2013, we have been in a secular bull market. The markets are rising quickly, there is constant innovation, and AI is leading the way for much of the growth we see.

But this is less about the secular bull markets. When I was reading Barry’s piece, I quickly began wondering how to mitigate a secular bear market. While it is tough to call tops and bottoms in the market, we can consistently allocate.

Compounding works best over long periods of time, and it works even better when we can consistently add to our portfolios.

So, let’s take a look at how things performed during these secular bear markets. For each of the secular bear markets, I will use Nick Maggiulli’s S&P 500 DCA Calculator.

1937-1950:

1966-1980:

2000-2013:

While these may not be the stellar annualized returns we have seen since 2013, there is something to be said for the prolonged ability to invest in stocks during secular bear markets.

If someone began investing $1,000 per month at the start of the 1966 secular bear market and continued that habit through today, they’d be pretty happy with their returns:

While this only focuses on a broad index like the S&P 500, let’s take a slightly more holistic view. Generally speaking, outside of the last 3 years, bonds can serve a very important role when it comes to bear markets. They can be a volatility dampener with the ability to provide moderate income for the investor.

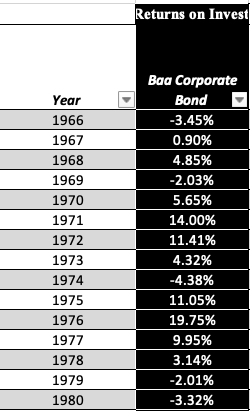

Here is how Baa corporate bonds performed during each of the secular bear markets listed above. The information regarding the bond returns is from NYU Stern. (A Baa-rated bond is considered the lowest on the totem pole of investment grade bonds, subject to a medium amount of risk)

If you ask me, those returns look more similar to the S&P 500 returns our generation knows! Diversification works, although it may not feel like it as of recent.

So yes, a secular bear market is on its way. It will inevitably come. Recessions, bear markets, pullbacks, and corrections are a part of every investor’s life.

How we react and the ability to put ourselves in a position to continue investing throughout these time periods can make a huge difference when it comes to longer-term investing.

And for those who may be spooked that this could happen towards the end of your career, let the asymmetric bond returns during secular bear markets ease your tension. This is an amazing example of diversification working; most pre-retirees are not invested the same way a 25-year-old would be.

So, while their stocks may not have been giving them what they needed, the bond position was there to lend a hand.

Dollar-cost averaging and proper diversification appear to be remedies to any prolonged bear market. It takes all of the emotion away and builds a regimented system around allocating funds. The most important part of dollar-cost averaging is that it is not interrupted.

I can’t tell you how many times seasoned veterans in the market will write off Gen Z. Yes, we have been programmed to buy the dip. Yes, we have been rewarded very quickly in doing so almost every single time.

But we also have a plethora of data at this point, years of market history, and our generation understands volatility better than previous generations give us credit for.

We all know that historical rates of return are not indicative of future results, but when it comes to market cycles, we can all make our educated guesses.

When the secular bear comes, allocating during those prolonged dips will be a true test of our ability to delay gratification. Just keep in mind our friend who invested $1,000 per month since 1966. I am certain they are not complaining now.