Leveraged ETFs are all the rage.

What are these products and how do they work?

Lately, new ETFs are hitting the shelves faster than most can keep count. There are a plethora of these things. You can literally find an ETF for almost anything.

Some of these ETFs are a bit more complex than others. That brings me to our topic of the day: leveraged ETFs.

These products have been around for some time. However, there are now tons of these ETFs tracking one singular stock. Not an index, not a basket of stocks, one singular stock.

They are much more complex than they may seem, yet younger investors usually ask the question, “If I am going to buy and hold, why wouldn’t I want MORE exposure for each dollar invested?”

There are multiple reasons why these products may not be suitable for the long-term investor. Just as there may be reasons as to why these products may be suitable for a very short-term gamble or speculative bet.

First, we must understand the products. Many of them use derivative instruments. These can be futures, options, or total return swaps. They may or may not not actually own the asset they are set to track at all, but rather own a derivative contract that is tied to the performance of the underlying stock.

This is important to note because, in order to access the leverage via the total return swaps, there are financing costs. Reviewing one of these ETFs’ holdings, I was able to identify that the financing rate for one of the swaps was over 9%.

This cost can be subtle and may not be made entirely apparent when taking a peek at a new ticker symbol. On top of these costs, the expense ratio of these funds can be substantial.

It is always important to understand the true costs of ownership when looking at different investments. For some, they may be able to rationalize the costs. For others, they may not be able to justify the costs relative to the potential benefits or pitfalls.

For anyone who wants to get really into the weeds of this topic, here is an amazing paper to further understand the costs associated with some of these products.

Alright, there are also potential headwinds when it comes to rebalancing. Because these ETFs reset daily, their longer-term returns can deviate significantly from twice the performance of the underlying asset. This effect is magnified in volatile, choppy markets. The paper linked above covers this idea in an in-depth manner.

Outside of these costs, the leverage associated with these ETFs amplifies the performance of the underlying. Again, these products are usually looking to track the DAILY performance. Most of them even include disclosures that state something of the sort.

For an example, here is the disclosure left on one leveraged ETF in particular: “The Fund will lose money if the underlying security performance is flat over time, and as a result of daily rebalancing, the underlying security’s volatility and the effects of compounding, it is even possible that the Fund will lose money over time while the underlying security’s performance increases over a period longer than a single day.”

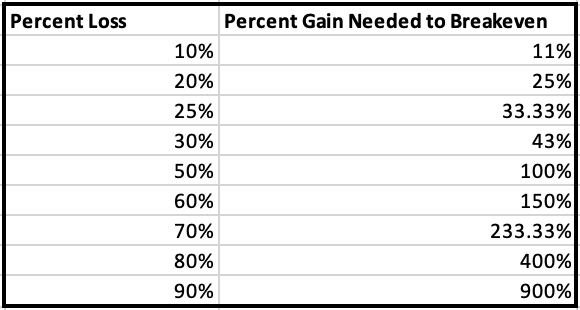

The easiest way to understand the potential pitfalls of leverage is by looking at the outline below, which will show the percent gain needed to break even after a decline:

So let’s put an example to the test to see how leverage can lead to a drag relative to an underlying outright stock.

Asset A starting value: $100

Day 1: -20%

Day 2: +25%

Ending value: $100

2x leveraged Asset A starting value: $100

Day 1: -40%

Day 2: +50%

Ending value: $90

From this very simple example, we can see that Asset A broke even on Day 2. However, the leveraged asset is still lagging by $10. A ways away from breaking even, although it did do exactly as it stated it would: 2x the daily performance of Asset A.

These products can look more like gambling than investing. Of course, for traders, they may be the easiest way to access leverage. There may be a time and a place for these products but understanding the potential pitfalls can be helpful when people look to allocate their hard earned dollars.

Of course, in an “up-only” market, these products have the potential to do well. The leverage can also amplify returns to the upside. However, that is not without additional risks, leverage costs, rebalancing drags, and frictions that occur in managing these ETFs.

The “Tariff Tantrum” earlier this year was a kryptonite for some of these leveraged ETFs. A 20% drawdown on the S&P 500 meant an even steeper decline for some of the more volatile issues within the index. Which, as you might have guessed, a lot of these leveraged ETFs choose to track.

Below, I will show the performance of the underlying stock so far in 2025 as well as the performance of its 2x leveraged counterpart. (Please note, this is not an endorsement of any individual stock or any leveraged ETF. This is solely for purposes of illustrating the leverage drag.) I will leave out the ticker symbols for each of the leveraged ETFs. These are just a few of the ones available to investors today:

Tesla 2x Leveraged Long ETF:

Tesla Stock:

2x Leveraged Long (Micro)Strategy ETF:

(Micro)Strategy Stock:

Here is an example of the leverage working slightly better. When a stock experiences an “up-only” period of time, these products do have the potential to outperform. However, it can be wildly hard to know which stocks will experience these extensive uptrends.

Robinhood 2x Leveraged Long ETF:

Robinhood Stock (Note this begins on Jan 31, 2025, when the ETF launched):

I’ll end it here. Young investors, I urge everyone to do solid due diligence before allocating hard-earned dollars. These products can be very difficult to understand, so I’ll end with a Warren Buffett quote: “Investment must be rational; if you don’t understand it, don’t do it.”

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.