Let’s get off the basics for a minute.

Reviewing some of the more nuanced items we saw during 2024.

I cover a lot of the basics. Let’s review some of the more in-depth and nuanced items I have seen.

Cash flow planning:

Large bonuses can lead to multiple levels of planning. A bonus coming in at 10 times the base salary is not something you see every day.

This was pretty cool to work on. Every now and then, you’ll get the privilege to work with someone who is really crushing it. Like their bonus is literally 10 times larger than their base salary crushing it.

A lot of planning comes into play with this type of windfall. A major liquidity analysis needs to be done especially when someone is living well outside of their base salary and into this bonus.

From the top, we work to be conservative in understanding expenses. This allows a margin of error to be built into the amount of cash that needs to be held to sustain their lifestyle over the course of the year.

From there, laddering Treasury Bills, municipal money market funds and high-yield savings accounts come into play. We want to focus on how to actually manage the cash as it is waiting to be used to cover expenses.

Ultimately, yield needs to be optimized according to the time horizon.

Investing:

I’m a nerd for this type of stuff. But this was one of the most fun proposals we were able to come up with for a client who was holding a position that was incredibly volatile. They knew where their pain point was (where they’d sell) and where they’d be happy to take some off the table.

Well, there’s a way to potentially get paid to do this using the options market.

Enter the collar.

This options play involves a long put and a short out of the money call. In plain English, we are selling a covered call and buying a put.

There is potential for this strategy to generate a net credit. If the price of the stock remains unchanged during the time frame of the options, you get to keep the credit and the stock!

If the stock goes down, you have an artificial floor built in which will mitigate further downside risk as you own a put option. The put option is the right but not the obligation to sell your shares at a set price.

We limit our upside gains with the short call. We would then have the obligation to sell in the event the shares traded above our strike price and the shares were assigned.

Obviously, this isn’t for everyone. But for large and volatile positions, this allows someone to have slightly more control over their investments than without it.

Retirement planning/business restructuring:

This is one of the wildest situations I have ever seen. I am honestly not sure how this gets overtaken in my career but hopefully it does because I love to see crazy planning concepts in real life.

Someone had structured their small business as a C-corporation prior to working with us. Immediately, we realized they were the only shareholder and that a C-corp structure was likely not the most efficient for their purposes.

This was a big change, so of course we consulted with an incredibly talented accountant about the viability of the plan.

We got the green light. As the business owner began working with the accountant to change the structure of the business for tax efficiencies, it became apparent that all of the company’s stock was held in their self-directed 401(k).

This was less than ideal to learn. However, as we worked with the accountant, we realized that an NUA distribution might be suitable.

I am summing this up very briefly. There were a lot of calculations run to compare the long-term tax advantages of the restructuring.

In the end, we moved forward with an NUA distribution from the plan. NUA or net-unrealized appreciation is a distribution strategy in which a single stock is involved with a 401(k) plan.

Usually, all distributions are taxed as ordinary income. In this case, that would’ve been sizable. However, with the NUA election, the basis of the shares will be taxed as ordinary income and the gains on the shares will be taxed at long-term capital gains rates.

This served as a massive windfall for this particular person.

This situation was an incredible example of how working with a very talented and well-versed CPA can be worth its weight in gold. Without the CPA, this would’ve been next to impossible and I am not confident that many tax-preparers would’ve caught this nuance.

Always remember that there can be a major difference between someone who just prepares your taxes and someone who gives you ongoing tax advice.

Working with a tax professional can be instrumental in optimizing any small business venture.

Estate planning:

In my opinion, the estate planning aspect of financial planning is the absolute best way to understand that we’re not just some person you hit up for a stock pick.

The federal estate tax exemption is $13.99M in 2025 and that doubles for married couples. This number is portable between spouses.

However, that is not the case in good ol’ New York State. NYS actually has its own rules when it comes to estate taxation and not being aware of them can result in a pretty bleak situation.

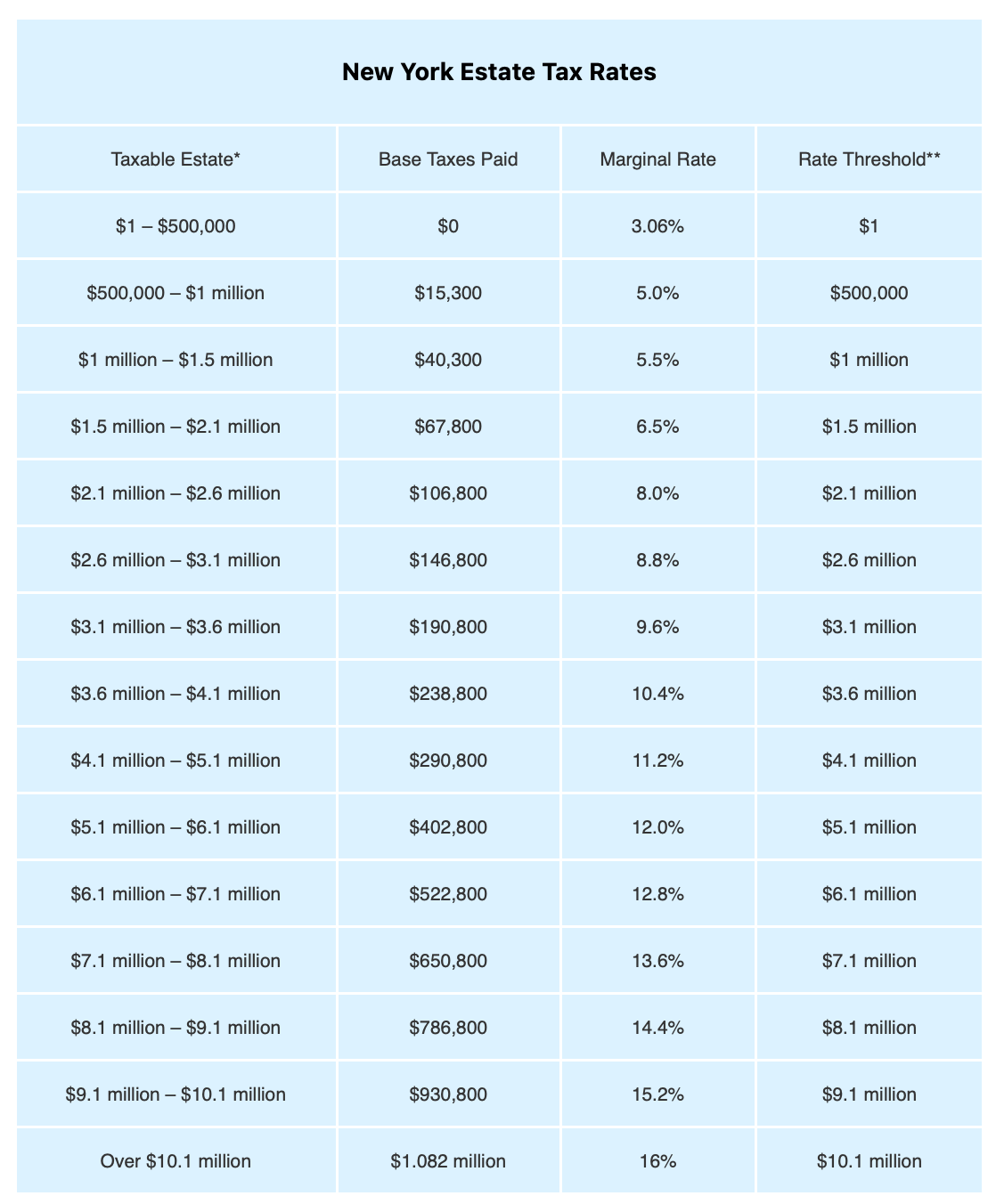

Naturally, there are legal ways to mitigate your estate tax bill in NY. But first, let’s talk about the NYS estate tax.

If your estate is worth $7.16M or less in NY at the time of death, you owe absolutely no taxes.

Pretty cool. What is not so cool is that there is a cliff. And I’m not talking about myself here. There is an estate tax cliff and if you fall off that cliff, it can be a six-figure misstep.

If your estate crosses $7.518M, you fall off the cliff. This results in your ENTIRE estate becoming taxable.

In the event you have a taxable estate of $7.6M, you will owe roughly $718,800.

Here are the tax rates from SmartAsset.

So, an estate worth $6.9M will actually net your heirs more than an estate worth $7.6M due to this NYS estate tax cliff.

We have worked a few times to mitigate this estate tax cliff issue. Usually, it is done hand in hand with advanced estate planning attorneys who work to put credit-shelter trusts in place.

The credit-shelter trust can allow one spouse to disclaim assets in the event it would push them over the estate tax cliff and direct the asset to trust after one spouse passes.

This then removes that previous household asset from the survivor’s taxable estate entirely.

A HUGE win when it comes to generational wealth planning.

That’s all for today, everyone. I have written a lot about young professionals, saving, IRAs, cash reserves and not timing the market.

I wanted to go a bit deeper this week! It is always nice to review the levels of financial planning.