Gen Z might not own homes but that doesn’t mean they don’t own assets.

Polls show Gen Z is investing earlier than previous generations.

I have heard a few different financial figures mention this idea of a “bullish” tailwind for the stock market. This idea revolves around younger generations passing up on home ownership, but allocating their capital to the markets.

On the surface, it seems pretty reasonable. I actually even agree with this take for the most part. Putting down 20% on a $500,000 home, or coming up with $100,000 in cash, might be outright unattainable for young professionals.

However, investing a smaller portion of their income each month may be much more palatable. This would mean that rather than saving cash for a home, younger people are actually investing in the market more regularly. This allows compounding to work its wonders, especially when there is a long-term time horizon.

With all of that said, there is some pushback from older generations around Gen Z and their finances. I think a lot of this stems from the housing market.

We all know a Boomer who bought a home for an incredibly low price relative to today’s prices. They have likely been sitting on that unrealized capital gain for decades. To them, renting may seem silly. In many cases, their home was the backbone of their financial security.

They paid their mortgage, the housing market caught fire, maybe they even cash-out refinanced during 2021 and got a sub 3% mortgage rate, and bam, they had hundreds of thousands of dollars in home equity.

But maybe it is different this time for our generation. It has literally never been easier to open an account and begin purchasing stocks or ETFs. The World Economic Forum had a study done in March that stated 30% of Gen Z began investing while in college or early after college, which compares to about 6% of boomers.

Based on a poll, Gallup found that 44% of those between the ages of 18-29 owned stocks. In 2024, Barron’s noted that Boomers hadn’t begun investing until the age of 35 on average. For Gen Z, the average age was 19.

This is really interesting to me. I think what Gen Z has identified is the potential opportunity cost. Saving cash over the last 5 years for a down payment on a home could have left someone feeling immense amounts of FOMO.

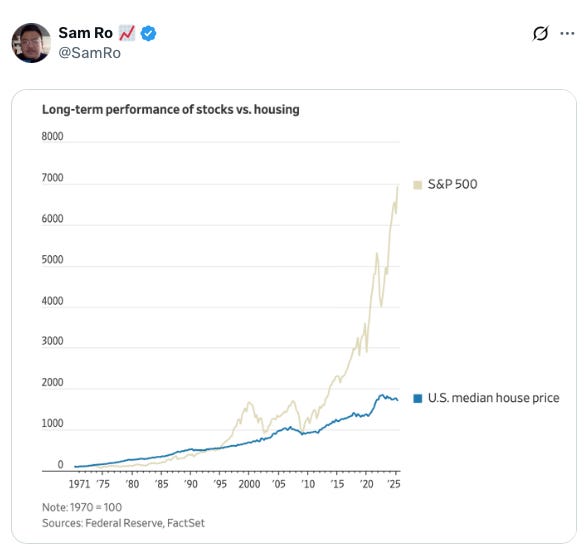

Look at the historical total return for the S&P 500 below:

2020: +18.40%

2021: +28.71%

2022: -18.7%

2023: +26.29%

2024: +25.02%

2025: +12.54%

These are eye-popping returns, and of course, we can’t be sure they’ll keep up. But that does not change the fact that Gen Z has watched the stock market appreciate heavily in their formative years.

For someone who began investing $1,000 per month in the S&P 500 starting in 2020, their balance has already ballooned to over $109,000 if the dividends were reinvested. They had only contributed $68,000 in total.

For someone who held cash, the risk-free rate was next to zero until it gradually went to ~5% during 2023. It has now come down, and most high-yield savings accounts are offering about 3.75%.

So maybe Gen Z is seeing that they can put their money to work earlier than other generations could. Technology is a major factor in this. Nearly unattainable home prices and the inability to service a mortgage payment could be another factor.

Of course, there hasn’t been a secular bear market in a while. This is likely another factor influencing Gen Z’s willingness to invest, as they have been heavily rewarded for doing so.

To some extent, I am living this truth. I would absolutely love to own a home. For the time being, it is completely unreasonable for me to spread myself that thinly, and I find that investing in the market is somewhere I’d personally rather allocate my money.

Of course, there are Gen Z folks who are buying homes. It just appears to be few and far between. Even some Millennials are having a tough time or feel locked into their starter homes with where rates are.

When it comes to financial planning, we generally do not include home equity as an asset for retirement. It is most certainly part of someone’s net worth, but it may not be as easily accessible as a brokerage account or 401(k).

Ultimately, there is always a tradeoff. Passing up on the opportunity to invest in the market in order to purchase a home is a potential opportunity cost.

It cuts both ways! Maybe owning a home would’ve been a better “investment” than buying stocks. With today’s housing prices, I think a lot of Gen Zers are saying, “You know what, I am so far off from owning a home, but I know I need to be investing.”

One thing I will note is that home purchases can be one of the biggest financial decisions someone makes in their life. They are not taken lightly, and ensuring someone is in the best shape to maintain their ownership is so important.

With that said, the ability to begin investing in the stock market has never been easier. The ability to purchase a home right now is, in my opinion, much, much harder. Most of Gen Z is baffled by a 6-figure down payment, which could also stand to increase their monthly housing expense relative to renting.

This could be a potential double negative in the eyes of some equity-focused Gen Z investors. They might prefer to keep that $100,000 invested in the market and save the difference between a mortgage payment and their rent cost.

I’d like to leave everyone with the post below from my friend, Sam Ro, the author of TKer, an amazing newsletter.

While some generations may believe home ownership to be the end-all be-all way of attaining wealth, this is not even close to true.

We cannot know how the housing market will perform, nor can we know how equities will perform. What I do know is that, in general, buying and holding assets over long periods of time can be a winning strategy.

Don’t feel rushed or pressured to own a home. Buying too much home or draining emergency funds and retirement accounts in pursuit of home ownership can create a ton of financial stress.

Gen Z has far more low-cost tools to become owners of assets than previous generations. Homeownership is definitely not the only avenue to building wealth, even if previous generations may think so.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.