For argument’s sake.

Roth IRA vs. Taxable Brokerage

Recently, I explained what direct indexing is, and ever since, I have been getting deeper into the weeds.

For those unfamiliar with direct indexing, here is the TLDR:

Rather than owning a few index funds, direct indexing breaks out each individual position. If the index is the S&P 500, it will literally own a prorated amount of each of the ~500 companies within the index.

The reasoning is that it allows for positions to be loss harvested. Capital losses can be used to offset ordinary income up to $3,000 each year, can be carried forward indefinitely at the federal level, and can be used against capital gains.

So, with all this talk and research into it, I wanted to come up with a scenario in which the almighty Roth IRA might be dethroned.

Now, please take this hypothetical with a grain of salt. Of course, there are going to be a lot of variables that are just that, hypothetical variables.

From a Kiplinger article, one direct indexing specialist’s research claims that over the course of a decade, 40% of the initial principal could be harvested as losses. So, if we had $500,000 invested, we could assume that over 10-years, $200,000 in losses would be realized.

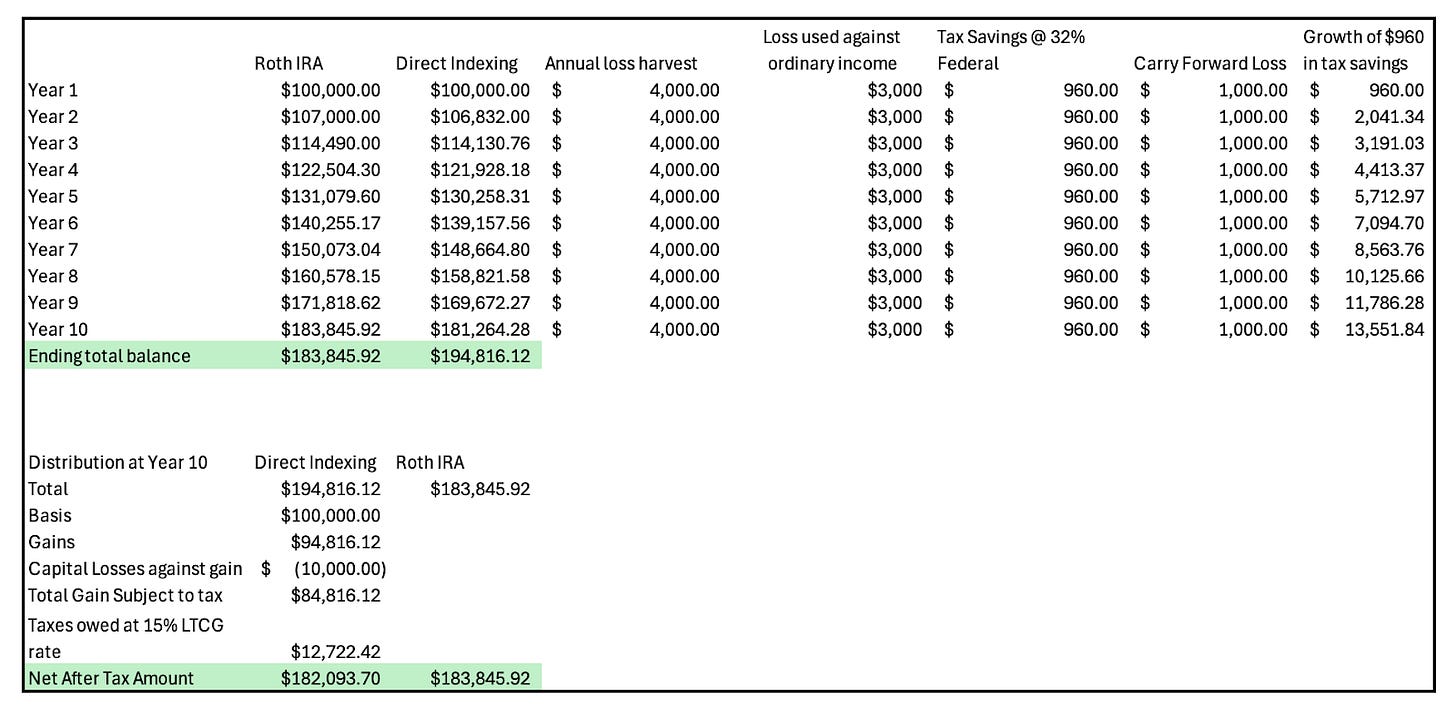

For our scenario, we will assume that an investor has $100,000 invested in a Roth IRA and $100,000 invested in their direct indexing account. The direct indexing account will follow the same index as the investment in the Roth IRA.

We will assume each portfolio grows at 7%. To go a step further, we will assume that the taxable brokerage account is growing at 6.832%. This represents roughly 16% of the total return being made up of dividends, which we are assuming are taxed at 15%.

We will also assume that our direct indexing losses of $3,000 will be used against income that would have been taxed at 32% and the money saved will be invested.

At the end of 10 years, the investor takes a full distribution of each account. (This is highly unlikely to happen, but it will show us the difference as we are keeping it constant for each account.)

Please note that the hypothetical scenario built out below is strictly for illustrative purposes.

Assuming the distribution was made after the age of 59.5, all of the Roth dollars would be distributed tax-free.

There we have it. The Roth IRA has $1,753 in additional dollars. However, this modeled out a one-time distribution.

A married couple filing jointly could theoretically have taxable income of $96,699 and pay $0 in taxes. Meaning a total of $128,199 in income could be realized while remaining in the $0 long-term capital gains tax bracket. (This includes a standard deduction of $31,500).

Theoretically, if a married couple had an income low enough, they could have taken the $94,816.12 in capital gains completely tax-free.

Meaning they would’ve actually generated $10,970 MORE than the Roth IRA did, which is entirely tax-free as well.

Of course, I wanted to model it out a little less in favor of the point I am trying to make. There were ample variables throughout this that frankly could be entirely different in real life.

However, I hope this piece serves to show what tax-aware investing can do. Keeping taxes in mind throughout the accumulation and distribution stages in one’s financial life can have a very meaningful impact.

I could throw additional tailwinds at the direct indexing model as well. Theoretically, the account could be borrowed against; the Roth IRA could not be. Then again, the basis in the Roth IRA could be distributed tax-free.

It never has to be all or nothing. Using different types of accounts allows for significant control during retirement.

Next time someone says that a Roth IRA is the end-all all be-all, you can share this knowledge with them! We can make a pretty sound argument for the taxable brokerage account when direct indexing is involved!

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.