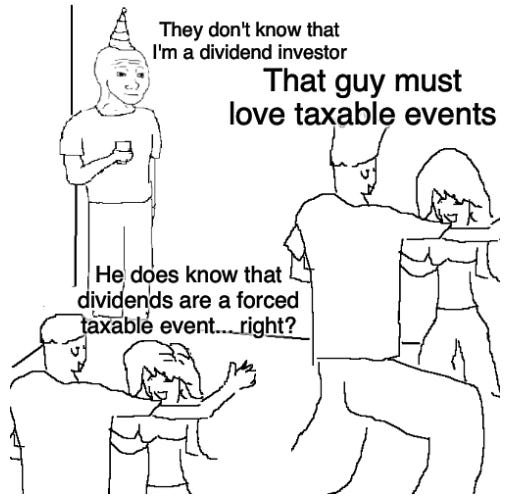

Dividends… it’s time we had this talk.

Forced taxable events are not my friend.

You have likely seen it or heard someone tell you about it. Maybe your parents, your uncle, your aunt, your grandparents… It seems that SO many people are focused on dividends.

“Passive income, bro. I’m going to escape the ‘matrix’ with my passive income.”

I’ve heard it so often. Everyone loves this idea of passive income. The idea that you personally did not work for anything and are distributed money just for owning shares in a company.

First off, a dividend is a distribution of a company’s profits to their investors. It isn’t a bad thing at all on the surface and when a yield bearing position is held within a tax-advantaged account, it is not much of a problem at all.

It is when it isn’t. A taxable brokerage account is mainly what I am talking about here. Every single time a dividend is paid, that represents a FORCED TAXABLE EVENT.

An investor has no choice in choosing to take the distribution (other than their choice of owning an investment). What if they are in a really high income year?

Dividends generally come in two forms:

Non-qualified/ordinary dividends: Taxed at marginal rate, just as income would be taxed.

Qualified dividends: Taxed at a more favorable rate, the long-term capital gains rate.

In order to be a qualified dividend, the dividend must be paid from a domestic corporation or a qualified foreign corporation, the shares must have been held for 61 days out of a 121-day period beginning 60 days before the ex-dividend date, and generally must be unhedged.

For those with buy-and-hold mentalities, they will likely be able to achieve a preferred tax treatment on their dividends from domestic companies.

However, a preferred tax treatment still means being subject to taxes.

I am not anti-dividend (maybe a little bit lol), but I am not a huge fan of taxable accounts investing for the sole purpose of yield. Especially when people are in their peak income years.

Here is a quick hypothetical for you:

Historically, 30% of the S&P 500’s total return has come from dividends.

If we consider an asset will grow at 8% but 30% of that 8% is in the form of a dividend, we can paint a picture of what tax-drag looks like.

We’ll do so by using a Roth IRA versus a taxable brokerage account. Roth IRAs grow tax-deferred and are generally distributed tax-free at age 59.5.

If we assume an 8% growth rate for the asset with 30% of that coming from dividends, the NET return is much more like 7.64%.

8% * 30% = 2.4% of growth subject to taxes.

Assuming a 15% qualified dividend tax treatment -> 2.4% * 15% = .36% owed each year in taxes.

8% - .36% = 7.64% NET return.

It doesn’t seem like a lot. In all honesty, at face value it seems like a rounding error. I can assure you, this small spread is not.

If we consider someone contributing $7,000 to their Roth IRA each year versus another person contributing $7,000 to their taxable account each year for 30 years with the above as our rates of return we get the following:

Roth IRA: $863,421

Taxable Account: $806,196

That is a difference of over $57,000.

Of course, the example above is meant to highlight the idea of tax-drag when investments are paying dividends. But this idea is very real.

Capital appreciation can be a much more tax-efficient manner to build wealth. Remember, positions can be sold. That puts the power in the hands of the investor to realize gains and put more control in their hands regarding taxable events.

Now, I also get that many broad based ETFs have a dividend/distribution component to them. So, in practice, it may be less feasible to actually avoid distributions.

Anyway, next time someone hits you with the, “Yeah, bro, I am focusing on passive income,” feel free to share these memes I made with them!

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.