An alternative way to borrow.

A quick chat with the CIO of SyntheticFi.

A few months ago, I came across an alternative way to borrow money: The box spread synthetic loan.

Generally speaking, most retail investors have access to two main ways of borrowing against their own investments: margin loans and securities-backed lines of credit.

In a higher-rates environment such as we are in today, alternative ways to borrow are always at the front of my mind.

Until recently, I had no clue that this was an avenue to borrowing! But before we begin, I want to make sure I review some key terms that may allow readers to better understand this strategy.

Long put option: The right, but not the obligation, to sell shares at a set price. (Sometimes, a put option can be compared to insurance.) An investor pays for the right to sell at a set price. Generally, a speculator may buy these in anticipation of a stock going down.

Short put option: The obligation to sell shares at a set price. An investor gets paid to sell this option.

Long call option: The right, but not obligation, to buy shares at a set price. An investor pays for the right to buy shares at a set price. Generally, a speculator may buy these in anticipation of a stock going up.

Short call options: The obligation to sell shares at a set price. An investor gets paid to sell this option. Short call options have an unlimited downside, unless they are “covered.” Covered means that the investor also owns the underlying stock to deliver in the event the shares appreciate substantially.

Strike price: This is the price an underlying security must reach to be executed upon.

Expiration: This is the date an option expires.

European options: Can ONLY be executed on the date of expiration; unlike American options, which can be executed at any time within the expiration date window.

As always, this strategy I am outlining is for educational purposes; this is not an endorsement, recommendation, or financial advice.

With that out of the way, we can discuss the strategy that I learned of a few months ago: Box spread synthetic loans.

For a quick background: This strategy is not simple. It is not for novice investors, and even some of the most experienced investors would not be able to execute upon this strategy. However, this strategy has been used for decades by some of the most sophisticated investors.

After learning of the strategy, I reached out to Joseph Wang, the CIO of SyntheticFi. Joseph is a financial expert with extensive knowledge in options strategies and box spreads. SyntheticFi is a platform that allows investors access to box-spread loans.

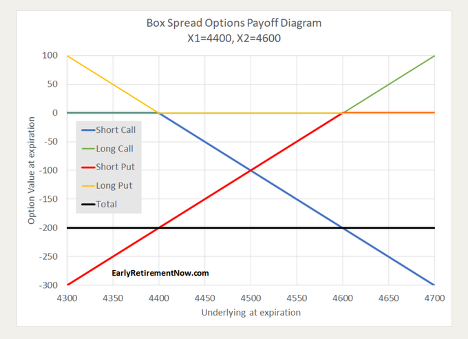

Essentially, a box spread “borrows” money from the options market. It is comprised of a long call, a short call, a long put, and a short put.

These 4 options, when all combined, create what’s known as a box.

The easiest way to explain it is as follows:

A call is sold, we’ll say the strike price we chose is 4,000.

This would result in an investor losing money in the event the underlying security went above 4,000.

But with the premium of selling the call (remember the investor is paid to sell the call), a put is purchased with a strike price of 4,000.

The put would appreciate in the event the underlying security went below 4,000.

The above strategy would be considered a “short” position. Meaning that if the underlying security went down, the investor would benefit. But we have not yet completed the box!

A put would then be sold; we’ll say the strike price is 5,000.

This would result in an investor losing in the event the underlying security went below 5,000.

A call would be bought with the premium received from selling the put. The strike would match the short put at 5,000.

In the event the underlying security appreciated, the investor would gain from this position.

This would complete the box! We now have both a short position and a long position. No matter where the underlying security ends at the expiration date, we have a defined liability.

The amount borrowed will eventually be repaid. This is where a counterparty exists. There is ONE individual or institution on the other side of EACH of the options mentioned above. Joseph kindly explained that this is why there is no price risk, as one singular entity is behind the opposite side of the entire box spread!

Since the counterparty risks are resolved by the OCC, or Options Clearing Corporation, the “lending” rates tend to be much closer to that of the risk-free rate.

The result is that the investor is left with a large premium upfront and a defined liability down the line when the options expire.

Boom. We have created a synthetic asset-backed loan.

For those who may be visually inclined, the graph below from Early Retirement Now does a great job showing the defined liability with the black line. At all times, no matter the value of the underlying security, the 4 different options will expire with the same amount of money owed.

When I first discovered this strategy, I had my doubts. But after a couple of days, it made total sense. Although it may seem complicated to understand at first glance, it is actually much simpler. It is really just math! (Trust me, this is much simpler to understand than it is to execute on.)

Now, why would this be advantageous to investors?

Right now, most securities-backed loans offer a rate of between 6.5% and 9%. The box spread synthetic loan aims to achieve a much more cost-effective rate of borrowing. Generally, box spread loans, depending on execution and other variables, aim to achieve a rate slightly higher than the risk-free rate.

This can offer a significant difference in the cost of borrowing. It can even be more tax-efficient, but that is for another time.

While this piece strays a bit from the topics I generally cover, it is so important to recognize the solutions that are becoming available to retail investors.

I would also like to mention that there are risks to this strategy, and it should NOT be implemented without the careful assistance of a true options and trading professional.

Joseph was more than nice in taking the time to walk me through everything. As an expert in the field of options and box spreads, he is truly an impressive individual, and his ability to explain the topic was so helpful to me.

Last week, I actually had the pleasure of meeting him in person and was able to thank him for his time at the Future Proof festival in Huntington Beach, California! We had an absolute blast catching up, and that is where I got the idea to write this piece!

While it may not be applicable to everyone, knowing that different avenues to borrowing exist is very powerful!

The information is general in nature and for informational purposes only. It should not be considered as investment advice or as a recommendation of any strategy or investment product, or an offer to buy or sell any specific security. We cannot guarantee the accuracy of information from third parties. This is not an endorsement of SyntheticFi by Bone Fide Wealth.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.