All-time highs aren’t your enemy.

The market is no stranger to all-time highs

We’ve got so much going on in the financial world today. We have the S&P 500 breaking 7,000, we have Mega Cap Tech like Microsoft losing $400,000,000,000 in market cap overnight, and crypto… As our crypto friends might say, they are “having fun staying poor.”

I hope everyone takes that with a grain of salt. Just trying to lighten the mood. But in all seriousness, yes crypto has been getting crushed. Oddly enough, everything else seems to be working. Stocks continue to chug along.

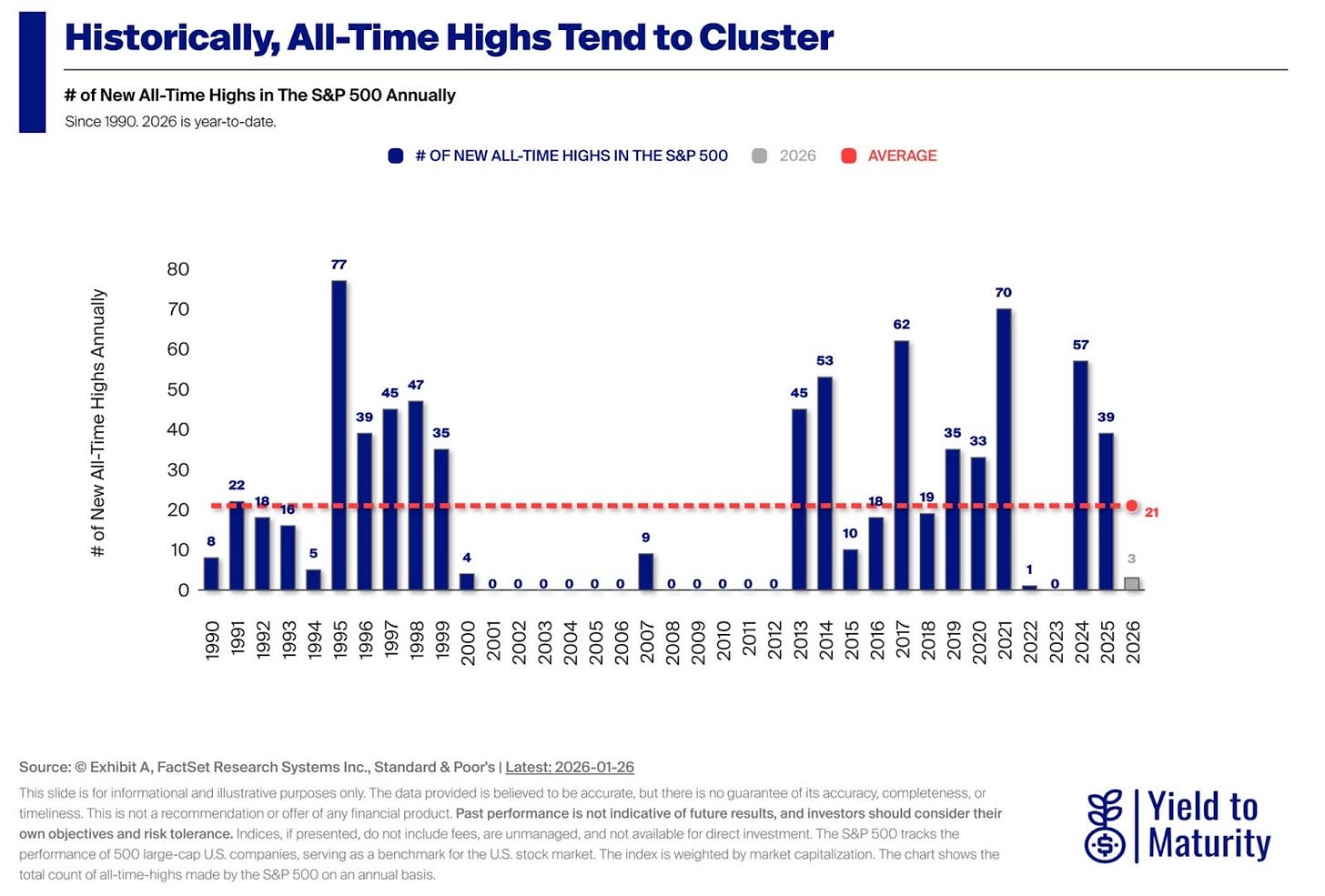

Now, the main point of this piece today is to become more accustomed to all-time highs, if you haven’t already. Our generation is no stranger to all-time highs. We have seen them constantly.

But all-time highs are not necessarily a reason to be spooked when it comes to investing. Since I began my career, the S&P 500 has made 170 all-time highs. It was about 4,350 when I first started working at Bone Fide Wealth. A few years later… 7,000.

And that included a full bear market. Feast your eyes on this wonderful chart from my good friend Chart Kid Matt. (Advisors, if you like what you see make sure to check out Exhibit A. Their charts crush it and they are totally custom… check out that YTM logo!)

Source: exhibitaforadvice.com

All-time highs tend to bunch up. Meaning that when the market is on a tear, that tear can continue for a while. The takeaway? All-time highs by themselves are a terrible reason to avoid investing.

Can they be considered in the grand scheme of things? Sure. But they are not the sole reason to avoid investing. If anything, we can argue that all-time highs beget all-time highs.

Now, with that out of the way, I am still hearing a lot of angst around the market and Big Tech or the Mag 7.

Interestingly enough, equal weight S&P 500 is outperforming the market-cap weighted S&P 500 as of recent.

To me, this is not a bad thing at all. This means more participation from smaller companies. A broadening out, if you will.

There have been years in which the largest companies drove all the returns for the S&P 500, but 2026 is already off to a hot start with the equal weighted index showing some strength.

Of course, this is over a one-month time frame, so we have to take it with a grain of salt. Nonetheless, the optimist in me wants to focus on some positives… or at least what I believe is a positive.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.