A bear market is probably coming… at some point.

Here’s why you shouldn’t worry too much.

The markets have roared back to all-time highs after the Liberation Day debacle. We have all 3 indices (Dow Jones, Nasdaq, and S&P 500) pushing right up on their all-time highs, if not exceeding them.

One cool thing about all-time highs - when the market reaches a new all-time high, every single person who has ever invested now has more money than they did prior. To me, it is such a weird way of posing what an all-time high means. Those who have been investing a portion of their paycheck each cycle have been massively rewarded.

This week, I wanted to focus on something a bit different. Generally, I am optimistic about the US stock market over long periods of time. I truly believe that long-term investing is one of the best ways to build wealth over time.

When it comes to long-term investing, you have to be prepared. Over the last 6 years, we have watched the market sell-off severely and in a very short period of time. COVID and Liberation Day come to mind. Investors experienced a 34% decline in the S&P 500 within 2 months when COVID rattled markets. Liberation Day was a 19% decline in just over a month.

When the market moves like that, it can be incredibly scary, especially when you consider how hard you worked to put that money away. You did everything right. You saved, practiced delayed gratification, and invested money for the long term. Only to watch 20% of it disappear over a few weeks.

Imagine someone had $100,000 right at the peak before COVID, only a few weeks later, their $100,000 dwindled to $66,000. This is even scarier for the pre-retiree who squirreled away $2,000,000 over their career and was ready to retire. Only to realize their nest-egg had become $1,320,000. Something of this nature highlights the idea of “sequence of returns risk.” But that is for another piece. Additionally, while it is scary, it’s unlikely that a pre-retiree would be totally allocated to the US equity market.

In either event, if an investor stayed strong throughout 2020 COVID Crash and the 2025 Liberation Day turmoil, their portfolio recovered and then some only a few months later.

When we think about investing, bear markets and sell-offs can be most people’s number one barrier to entry. But here is the thing… There is going to be a bear market.

I have been working in financial services for 4 full years now. Most people classify the Liberation Day turmoil as a bear market. If you include that, I have already seen two bear markets in my career.

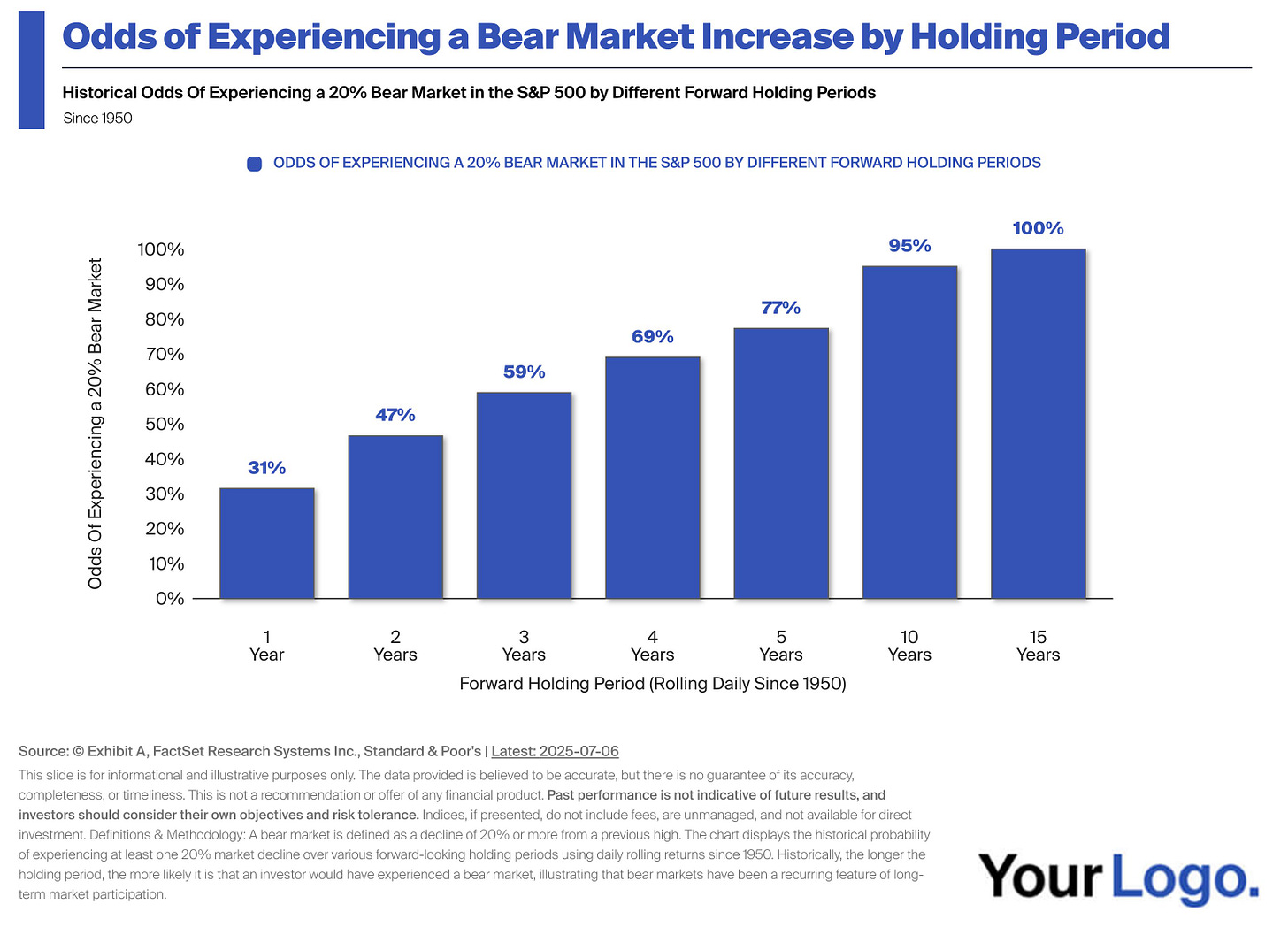

Check out the chart below from my friend, Chart Kid Matt over at Exhibit A. Exhibit A is an awesome way for advisors to get access to custom-branded charts for their own clients.

I love this chart. I have not yet seen anything like this. I think that this chart is so important because of how it normalizes bear markets. If you have invested for 5 years, there is a 77% chance you will experience a bear market.

As time passes, the odds eventually reach a 100% chance. We can’t know when, we usually can’t know how, but experiencing a bear market is totally normal.

When I talk about long-term investing and being generally bullish over time, I also understand that the market will have periods of decline. However, the periods of decline and bear markets are not necessarily something to avoid. They are simply part of being a long-term investor.

As time goes on, there is an increased chance of growth in US stocks. At the same time, there is an increased chance of experiencing a bear market. Both are true, yet one can bar people from investing. It can be very hard to have your cake and eat it too in the market.

For those of us who take the passive stance on investing, we are not only ready for the impacts of compound growth, but we are ready for the bumps along the way.

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.