50 years of mortgage payments.

Reframing debt, flexibility, and investing.

The proposal of a 50-year mortgage has been highly debated over the past few weeks. Extending the typical 30-year liability by an additional 20 years can seriously increase the total interest paid.

Homeownership is feeling out of reach to many Americans, and the age at which people are buying their first home continues to increase relative to historical levels.

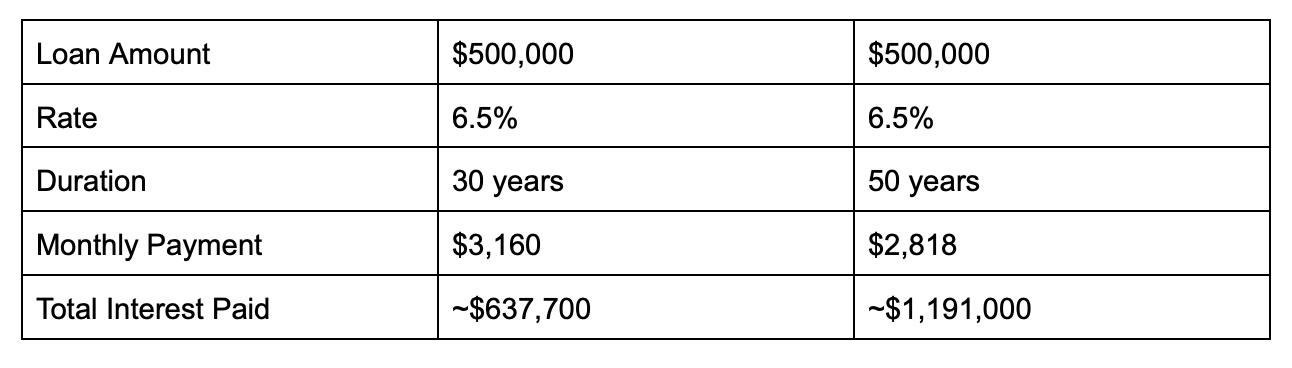

Let’s take a look at some numbers to better understand the impact an additional 20 years may have.

That is over half a million extra dollars towards interest payments throughout the life of the loan. However, the monthly payment was only decreased by $342 or $4,100 annually.

So, at face value, this looks kind of nuts. However, to play devil’s advocate, let’s see what would happen if the person who assumed the 50-year mortgage invested the $4,100 annually for 50 years at the end of each year.

The 30-year mortgage holder will not invest at all, except for when they have paid off the entire note. Then they will invest the entire $37,920 they would’ve put towards their mortgage payment each year for 20 years.

Let me be very clear that there are some significant assumptions here, which are not projections, and most definitely not guaranteed. We will assume each investor achieves an average annual return of 7.5% over the course of the 50 years.

50-year mortgage holder ending portfolio value: ~$1,978,000

30-year mortgage holder ending portfolio value: ~$1,642,000

To be objective here, if we changed the rate of return to 6%, the 30-year mortgage holder would have a higher balance in their investment account. To be clear, the spread in mortgage rates, rates of return, and loan size could all vary.

While the 50-year mortgage holder paid over $500,000 extra in interest, their ability to begin investing earlier allowed their portfolio value to grow by an additional $336,000.

Each of them ends with the same home! The home value and each person’s equity in the home are equal at the end of 50 years.

I am not advocating for a 50-year mortgage at all. In all honesty, I think there are too many avenues to financing just about anything these days. I just think it is important to take different approaches to how we view debt, investing, and long-term obligations.

Nonetheless, while I am not a total fan of 50-year liabilities, could it potentially offer flexibility? Objectively, yes.

Less any prepayment penalties, the 50-year note lowers the monthly payment, but it does not say that someone couldn’t accelerate the payments. Sometimes people debate a 15-year mortgage, which is usually associated with a lower rate and significantly less interest than a standard 30-year mortgage.

However, many financial advisors argue that the 30-year mortgage can offer more flexibility on the monthly payments and can be paid off early in the event the individual wants to remove the liability.

Now, this all looks interesting in a vacuum. But humans are dynamic. Their lives change, they move homes, they change jobs. While the 50-year mortgage could potentially offer more flexibility on a monthly basis, it is important to note that the average stay in a home is 12 years.

Over 10 years, only about $16,000 in principal would’ve been paid on the 50-year mortgage at 6.5%, whereas $66,000 in principal would’ve been paid with the 30-year note. That is a wild spread! No matter the term, the longer one continues to pay down their debt, the more principal they will build in the property. The inability to build principal can be exacerbated by extending the term of the loan or resetting the term when moving.

It is usually pretty easy to evaluate financial decisions in a controlled environment. We can optimize for taxes, performance, and mitigate volatility to the best of our ability, but we cannot predict the future.

Sometimes, flexibility is the most important aspect of a financial decision.

Bonus content: Inflation works for borrowers and against savers. A fixed payment of $2,500 would have the equivalent purchasing power of $8,600 after 50 years if inflation were ~2.5%!! Yet the payment stayed stagnant the entire time!

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.