2025 was the year of precious metals

Did you miss out?

There is no question, gold and silver had an incredible year in 2025. For some gold bugs, their conviction finally paid off with Gold up over 60% through 2025.

That is a stellar year. Silver did even better, ending the year up over 140%. These two assets had somewhat of a Cinderella story in 2025. They were largely not paid any attention throughout the past 5 years. Well, not entirely. Peter Schiff has been shouting from the rooftops since before I was born.

With everyone a bit antsy about the performance and constant media coverage, FOMO has crept in.

I think I have driven the point home that I am a full believer in risk-adjusted, long-term portfolios. When an asset class like this goes parabolic, I always want to add some context.

For those that saw this coming, my hat is off to you. Great trade. For the passive investor like myself who might be feeling some FOMO, let’s pump the brakes.

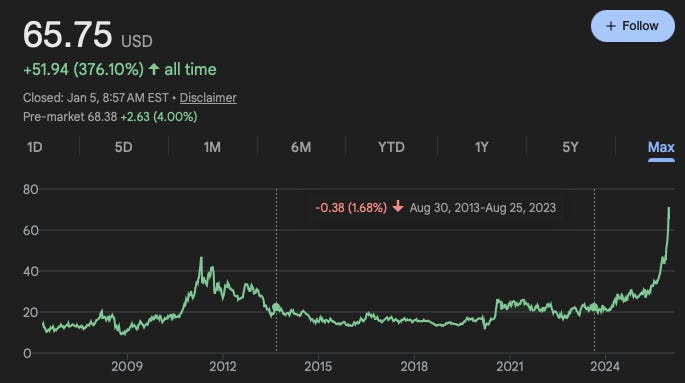

Here is a chart of a Silver Trust from Google Finance.

Why is this important? Well, you can see that although silver has been recognized as an asset for about 6,000 years, it is not necessarily something that has consistently gained value year over year.

Over the same timeframe (April 2006 - today), the S&P 500 is up roughly 423%, without accounting for dividends that could’ve been reinvested. And, we have to note that silver has made a significant amount of those gains as of recent.

I can assure you that no one felt any FOMO during this decade’s span of time when silver went absolutely nowhere.

I’m not here to say gold and silver are bad or good. They are just assets that market participants buy in hopes of selling at a higher price down the line. Pretty standard in the investment world.

Ultimately, I want to pose things differently than the traditional finance media would. Rather than talking about what a stellar 2025 silver had, let me rephrase:

“If an asset was dead flat for over a decade, would you still continue to allocate?”

For those that were allocating consistently to silver, they are now sitting on a handsome unrealized gain. However, it took years. For some, more than a decade to really see any significant gains.

The lesson here is patience. The hardest part of investing is doing nothing or continuing to build positions as nothing is happening or better yet, when they are falling apart.

When an asset class performs, it is really easy to want to join in on the potential fun. I’m more focused on the long-term wealth accumulation to let one year of returns for an asset class derail my approach.

Bonus content:

Gains on collectibles such as precious metals are taxed differently than most capital assets. Collectibles qualifying for long-term capital gains treatment can be taxed at a maximum of 28% federally! Much higher than the 20% we’d associate with stocks, bonds, etc.

Double bonus:

I had the privilege of writing for Barron’s last week. If you want to know my top 3 reasons for hiring a financial advisor, check it out here!

This is for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of publication and are subject to change without notice. Past performance is not indicative of future results.